International Tax Law

In today’s global economy, managing international tax matters requires a strategic and nuanced approach. At Aliant, we know that cross-border tax planning is about more than compliance—it’s about finding opportunities for growth and efficiency. Our team brings together expertise across jurisdictions, working with multinational corporations, private companies, investment firms, and high-net-worth individuals to build tax strategies that work globally.

Our services include:

- Cross-Border Tax Planning – We help you structure tax-efficient investments, transactions, and financing across borders, minimizing liabilities and managing risks in foreign markets.

- Transfer Pricing & Dispute Resolution – From setting transfer pricing policies to handling disputes with tax authorities, we provide strategies that keep you compliant and prepared.

- Tax Controversy & Litigation – When disputes arise, our team is there to represent you through audits, investigations, and litigation across multiple jurisdictions.

- Corporate Transactions – For mergers, acquisitions, divestitures, and spin-offs, we handle the tax aspects to maximize value and meet regulatory standards in each country involved.

- Private Client Advisory – We offer personalized tax planning for high-net-worth individuals, from asset protection to expatriation and managing international estates.

- Investment Structuring & Compliance – We guide you through the tax and regulatory considerations of foreign investments, helping you understand the implications in emerging markets.

With Aliant as your partner, you gain a team that understands the intricacies of international tax law and is committed to helping you stay compliant while maximizing your global tax position. Let us help you unlock opportunities and achieve sustainable success worldwide.

International Tax Law Attorneys

Switzerland

Corporate Restructuring, Employment & Labor, International Tax Law, Personal Tax

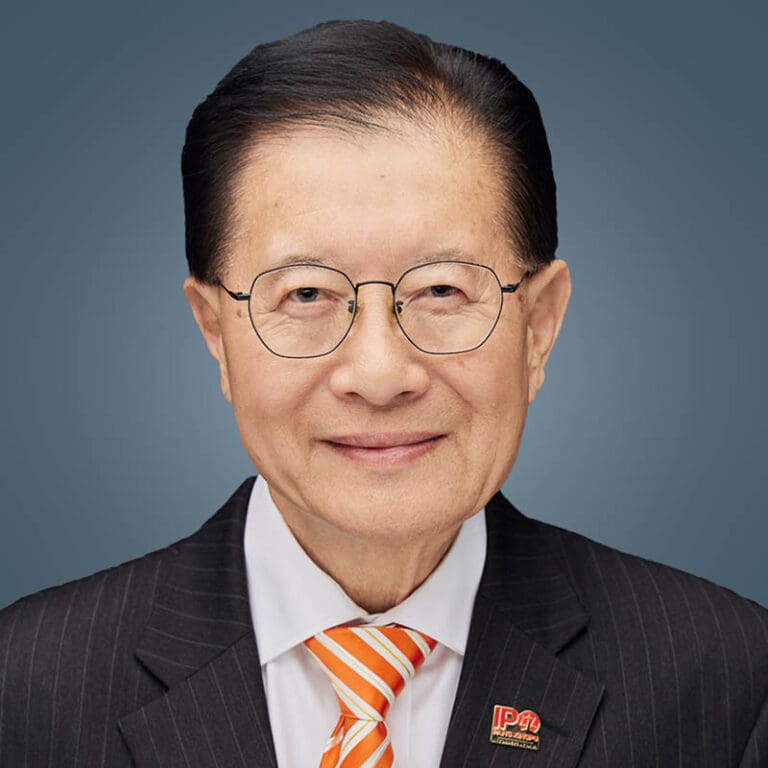

China

Business Law, Employment & Labor, International Investments, Intellectual Property, International Tax Law, Joint Ventures, Litigation, Mergers & Acqui

United Kingdom

Bankruptcy & Insolvency, Civil Law & Civil Asset Recovery, Corporate Transactions, International Tax Law, White Collar Crime & Investigations

Brazil

Business Law, Civil Law & Civil Asset Recovery, International Tax Law

United States

Corporate Transactions, International Investments, International Tax Law, Private Wealth Management & Estate Planning

Costa Rica

Business Law, Civil Law & Civil Asset Recovery, Commercial Agreements, Corporate Restructuring, Corporate Transactions, Employment & Labor, Internatio

Switzerland

Blockchain & Cryptocurrency, Commercial Agreements, International Tax Law

Hungary

Business Law, International Tax Law, Mergers & Acquisitions, Private Wealth Management & Estate Planning

Hungary

Business Law, International Tax Law, Private Wealth Management & Estate Planning

France

International Tax Law

Exceptional People True Stories

“I once joined a client at a straw field to watch the collecting and packing of straw that was to be sold as biomass to a CHP plant. I learned that day that the calorific value of straw depends on the amount of moisture in the air. So, to better negotiate for my client, I am now an expert on individual calorific values of different types of straw based on humidity levels.”

-Małgorzata Krzyżowska, Poland

More About Aliant Attorneys

Exceptional People True Stories

“I once joined a client at a straw field to watch the collecting and packing of straw that was to be sold as biomass to a CHP plant. I learned that day that the calorific value of straw depends on the amount of moisture in the air. So, to better negotiate for my client, I am now an expert on individual calorific values of different types of straw based on humidity levels.”

-Małgorzata Krzyżowska, Poland

More About Aliant Attorneys