In an age where the wealth of the world’s elite continues to surge to unprecedented levels, the need for effective wealth management solutions has become more pressing than ever before. The modern, affluent family is faced with a sophisticated web of assets, investments, and financial intricacies. Managing thfkjis complexity necessitates a high level of expertise and constant vigilance. It is in this environment that the concept of a family office has taken root.

What is a Family Office?

A family office is essentially a private wealth management entity offering a comprehensive set of customized financial and legal services tailored to meet the unique needs of wealthy families. The services encompass far more than traditional wealth management and financial planning; they extend to the intricate management of all aspects of family wealth. Today’s family offices are often multi-family offices, serving multiple affluent families concurrently and engaging top-tier professionals who bring an unparalleled depth of expertise and knowledge to the table.

Who Needs a Family Office?

Every high-net-worth family can benefit significantly from the establishment of a family office, particularly if the family’s leader is directly responsible for the complex and multifaceted financial affairs. A family office is the guardian of financial peace, ensuring round-the-clock attention to the family’s financial landscape, allowing wealth to flow harmoniously even as families relish their prosperity.

Family Office Services

A specialized family office service excels in delivering tailor-made solutions, understanding that the needs and goals of each family are distinct. The comprehensive range of services they provide include:

- Wealth Planning: Family offices provide a tailored and all-encompassing approach, designed to meet the unique needs of individual family members. It seamlessly integrates complexity, flexibility, and agility to harmonize intricate financial strategies.

- Financial Planning and Cash Flow Analysis: They engage in meticulous financial planning, scrutinizing every facet of wealth movement. Their aim is to align resources with the family’s aspirations, ensuring a smooth financial journey.

- Goal-Based Investment Management: Family offices specialize in careful investment selection, ensuring that investments are seamlessly aligned with your family’s specific goals and aspirations. This approach results in a purposeful and strategically crafted investment portfolio.

- Asset Protection and Risk Management: Think of them as the financial bodyguards for your wealth. Their asset protection and risk management strategies are designed to shield your wealth from harm and navigate the sophisticated waters of financial risk with precision.

- Tax Planning: Family offices provide professional teams who skillfully navigate the complexity of the tax code, working to minimize your tax liabilities while adhering to all legal requirements, ensuring your financial health.

- Private Banking Advisory: Their team of financial experts provide advisory services to help you choose the ideal private bank that suits your unique financial needs and helps your family’s portfolio grow and thrive.

- Estate Planning: Building a lasting legacy is a methodical process, and the estate planning services Family offices provide are the deliberate steps that create a solid foundation. They ensure that your family’s wealth is structured to provide benefits across generations.

- Family Office Governance and Education: Family office advisors serve as mentors in the field of wealth management, guiding your family towards financial enlightenment. Thei aim is to foster harmony and prosperity across generations through careful governance and education.

- Philanthropic, Charity, and Gift Planning: A Family office can assist you in crafting a legacy of charitable giving, efficiently coordinating philanthropic initiatives that align closely with your family’s core values.

- Yacht, Jet Aviation, and Vintage Car Management Services: Their expertise usually extend beyond finance. They provide expert management of your prized possessions, ensuring that your lifestyle aspirations soar to new heights.

- Administration Services: Working behind the scenes, the precise management a Family office can ensure the seamless operation of all your financial affairs.

- Accounting and Financial Reporting Services: Family offices serve as your financial analysts, skillfully translating raw financial data into insightful narratives that empower you with the information required to make well-informed decisions.

In the world of family office services, the value of offering tailor-made solutions is paramount. This approach recognizes the unique and multifaceted needs and aspirations of each family, allowing for services that perfectly align with their specific circumstances. With a dedicated team of professionals, the ability to customize services becomes pivotal, ensuring that the ever-evolving requirements of the family are met with precision and care.

The Key Benefits of Having a Family Office

The advantages of having a family office extend beyond merely streamlining financial management. The integrated services provided by a family office offer:

- Reduced Stress: The complex wealth management process becomes far less stressful, granting affluent families’ peace of mind.

- Centralized Control: Every financial aspect of the family is managed in one place, allowing greater oversight of professionals working on the family’s behalf.

- Privacy Protection: Family offices provide a remarkable level of privacy by restricting third-party access to sensitive financial and business information.

- Flexibility and Speed: Family offices are equipped to offer extraordinary solutions swiftly when exceptional situations demand it, a level of flexibility that traditional investment companies often struggle to match.

Diverse approaches to family office services are adopted around the world. In the following section of the article, we will discuss Hungary’s distinctive approach and explore its unparalleled benefits. Family Office solutions in Hungary are committed to delivering services that leverage the unique advantages offered by the Hungarian Asset Management Foundation (AMF) and the Hybrid Trust to address the specific needs of clients.

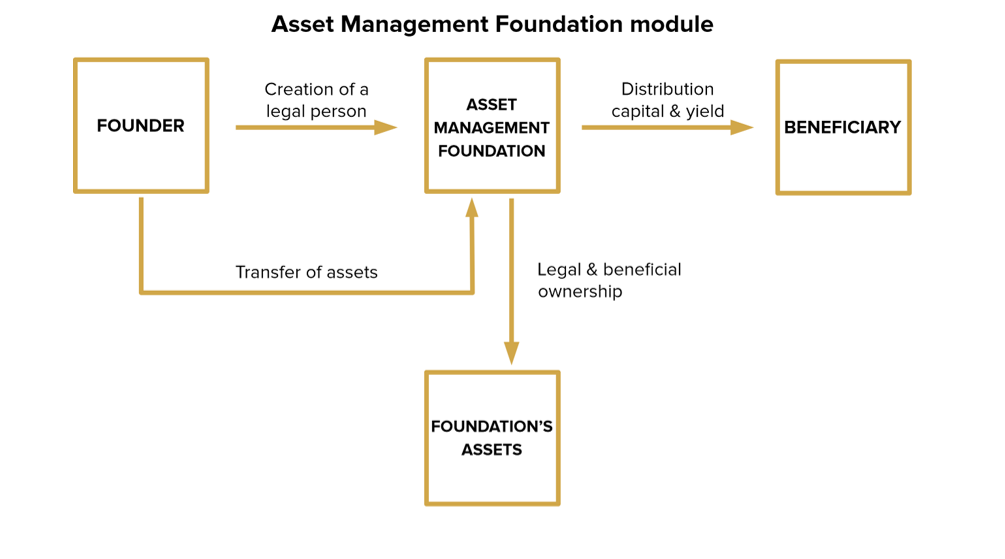

Asset Management Foundation for Publicly Visible Assets

One of the key elements of the Hungarian family office structure involves the strategic use of the Hungarian Asset Management Foundation (AMF) for managing publicly visible assets, such as companies and shares. The AMF serves as a powerful tool for structuring and preserving wealth while providing a range of further benefits.

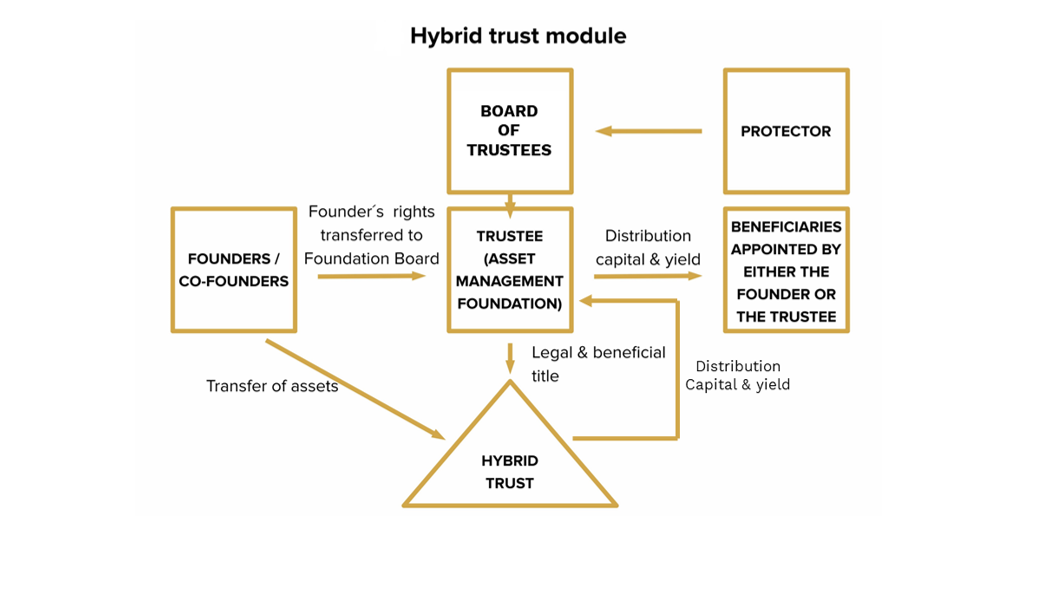

Hybrid Trust for Publicly Not Visible Assets

While the AMF is an excellent choice for managing publicly visible assets, the Hybrid Trust offers a unique solution for handling assets that are not visible publicly. These assets may include investments, art collections, cash, and other holdings that require a more discreet and confidential approach.

By segregating publicly visible and not visible assets and leveraging the advantages of the AMF and Hybrid Trust, the Hungarian family office structure offers a comprehensive and tailored approach to wealth management and reflects clients’ desire for privacy and efficient asset management.

Introducing the Asset Management Foundation

Before the introduction of the Asset Management Foundation (AMF), Hungarian trusts and family foundations were the primary legal solutions for estate planning and wealth management. However, the Civil Code limited foundations from engaging in economic activities other than those directly relevant to their purpose. As a result, Hungarian trusts gained popularity due to their ability to conduct economic activities. But with a maximum duration of 50 years, they proved unsuitable for multi-generational wealth preservation and growth.

To address this limitation, the legislators introduced the Asset Management Foundation (AMF), a unique foundation type designed to perform asset management as its primary economic function. The AMF can effectively serve families looking to manage their wealth across generations.

The primary duty of an AMF is to make distributions to beneficiaries specified in the founding charter. The AMF Act allows for the creation of open circle beneficiary AMFs for public interest purposes.

Key Elements of the AMF Act

The AMF Act applies to Asset Management Foundations formed and registered as such. AMFs are a sub-type of foundations governed by the Civil Code, with their activities distinguishing them. They can manage assets and engage in investment activities only with the foundation’s own assets, prohibited from providing investment advice or services to third parties. AMFs can also manage assets placed under their trust management as an economic activity.

AMFs are not subject to the Trustees Act, allowing them to provide trustee services without licensing for specific relationships. Founders can transfer assets to an AMF for fiduciary asset management purposes. In such cases:

- The AMF is considered the sole beneficiary of the fiduciary asset management.

- There is no maximum duration of fiduciary asset management.

- The AMF is subject to the strict confidentiality requirement of the Civil Code.

- Founders transferring assets to the AMF for fiduciary asset management can instruct the board of trustees.

- AMFs can establish companies or acquire shares in companies as per their founding charter.

The AMF Act aims to ensure AMFs are self-sustaining, with founders having the option to waive their founder’s rights and appoint a foundation body. Several mandatory provisions relate to the organization of AMFs, including the requirement for at least one individual member with Hungarian residency on the board of trustees, limitations on legal persons in the board, the appointment of a supervisory board or protector, and the appointment of a permanent auditor.

Beneficial Ownership and the Asset Management Foundation

The determination of beneficial ownership differs in the case of a trust relationship managed by an AMF, offering unique privacy protection for sensitive business and financial information. The Hungarian AML Act defines beneficial owners within the context of AMFs, deviating from the general rules:

- The beneficial owner may be an individual with a property interest of at least 25% in the AMF.

- The beneficial owner may be the individual in whose main interest the foundation was set up or operates, exercising control over the board of the AMF.

- The AMF’s board is considered the beneficial owner when future beneficiaries are not appointed and there is no individual with at least a 25% interest in the AMF’s property.

- In the case of a hybrid structure where a trust is managed by an AMF, the determination of beneficial ownership is notably different: according to the AMF act, in these cases there is no settlor.

In summary, Hungarian Family Office services, with the unique features offered by the Asset Management Foundation and Hybrid Trust structures, not only provide comprehensive wealth management but also unprecedented privacy protection, making them a valuable asset for affluent families in today’s complex financial landscape.

FOLLOW US ON LINKEDIN

SEE MORE OF ALIANT BLOGS HERE.